What Does Summitpath Llp Do?

7 Simple Techniques For Summitpath Llp

Table of ContentsTop Guidelines Of Summitpath LlpSome Known Details About Summitpath Llp Facts About Summitpath Llp RevealedSome Known Details About Summitpath Llp Summitpath Llp - Questions

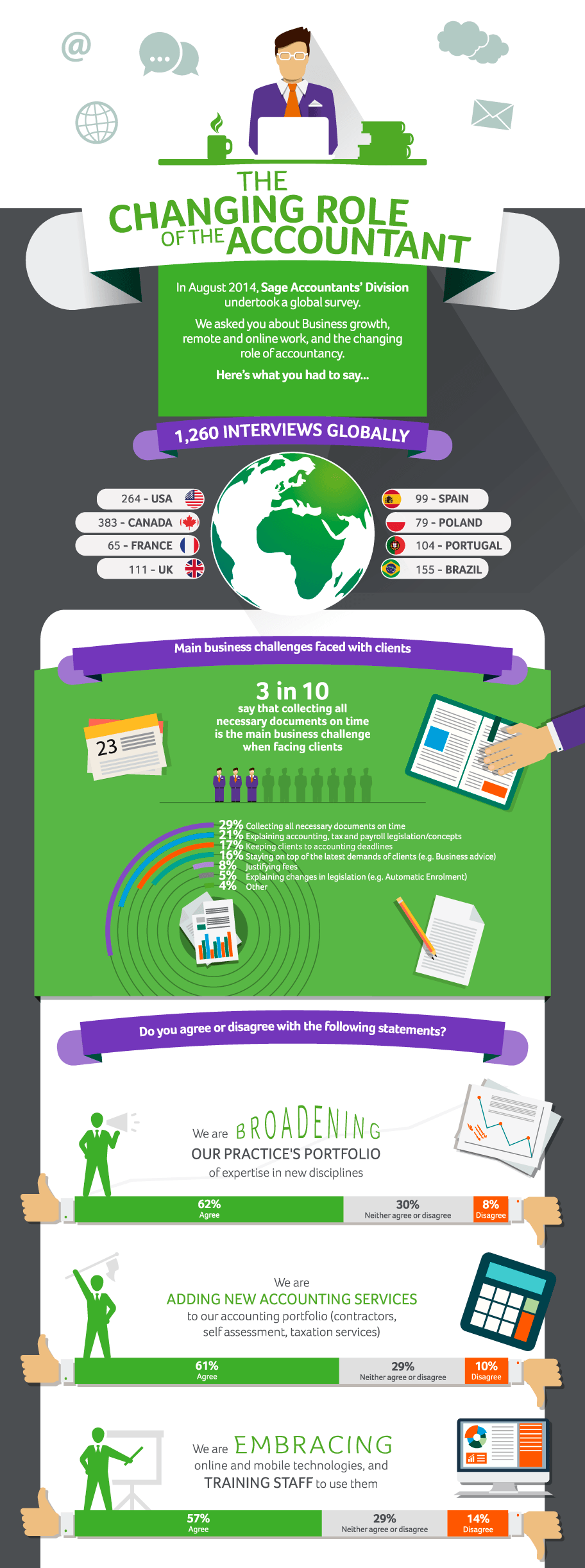

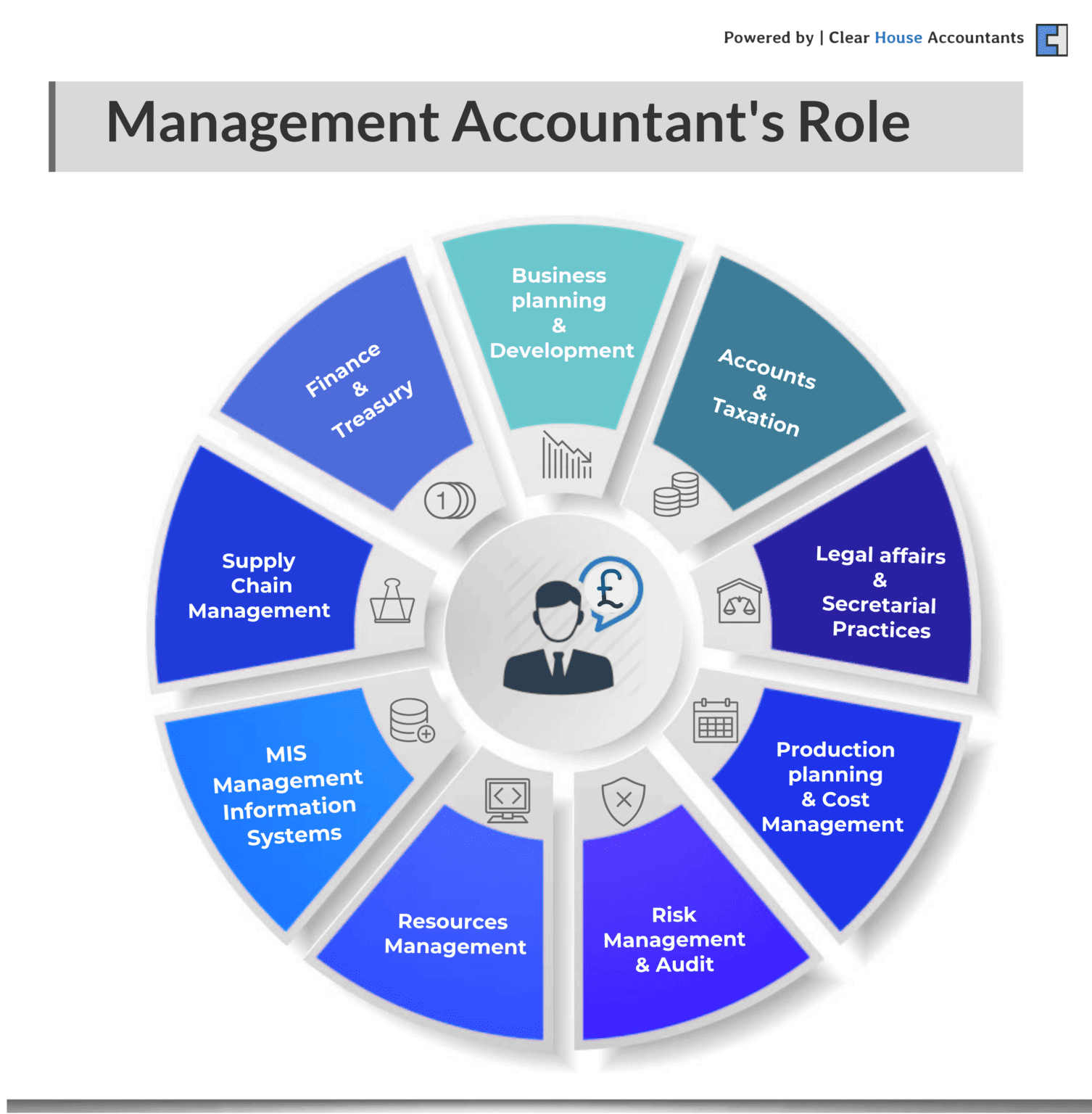

A monitoring accountant is an essential role within a business, but what is the function and what are they anticipated to do in it? ICAEW dives much deeper in this management accountant guide. https://www.dreamstime.com/josehalley18_info. An administration accountant is a vital duty in any type of organisation. Operating in the book-keeping or financing department, monitoring accounting professionals are responsible for the prep work of administration accounts and several various other reports whilst also looking after general accounting treatments and practices within business.Putting together approaches that will minimize organization costs. Acquiring money for projects. Encouraging on the economic implications of service decisions. Creating and overseeing monetary systems and treatments and recognizing chances to boost these. Managing revenue and expense within the company and making sure that expense is inline with budgets. Overseeing bookkeeping professionals and assistance with common book-keeping jobs.

Analysing and managing risk within business. Management accountants play a highly important role within an organisation. Key financial data and reports produced by management accountants are made use of by elderly monitoring to make enlightened organization decisions. The evaluation of company performance is a vital duty in a management accountant's task, this analysis is created by considering present monetary information and additionally non - financial information to figure out the setting of business.

Any kind of service organisation with a financial department will certainly require a monitoring accountant, they are likewise frequently utilized by banks. With experience, a monitoring accountant can expect strong career development. Professionals with the needed qualifications and experience can go on to come to be financial controllers, financing supervisors or chief financial police officers.

The Definitive Guide to Summitpath Llp

Can see, assess and encourage on alternating resources of service money and various ways of raising money. Communicates and suggests what impact financial choice production is carrying growths in law, values and administration. Assesses and encourages on the best techniques to manage business and organisational performance in connection to company and finance threat while connecting the effect successfully.

Makes use of various cutting-edge methods to execute approach and manage modification - CPA for small business. The difference between both economic audit and managerial bookkeeping problems the intended users of info. Supervisory accounting professionals require service acumen and their aim is to function as organization partners, assisting magnate to make better-informed decisions, while financial accountants intend to create economic records to supply to external parties

The Single Strategy To Use For Summitpath Llp

An understanding of business is also vital for monitoring accounting professionals, together with the capability to interact efficiently whatsoever levels to advise and communicate with elderly members of staff. The duties of a monitoring accounting professional ought to be carried out with a high degree of organisational and strategic reasoning abilities. The ordinary wage for a legal management accountant in the UK is 51,229, an increase from a 40,000 typical earned by management accounting professionals without a chartership.

Offering mentorship and leadership to junior accounting professionals, promoting a society of partnership, growth, and functional excellence. Teaming up with cross-functional teams to create budget plans, forecasts, and long-lasting financial approaches. Staying educated regarding changes in accountancy policies and ideal methods, using updates to interior procedures and documentation. Essential: Bachelor's level in accounting, financing, or a relevant field (master's favored). CPA or CMA qualification.

Versatile job alternatives, including hybrid and remote schedules. To apply, please submit your return to and a cover letter describing your credentials and passion in the elderly accounting professional function (https://experiment.com/users/summitp4th).

Indicators on Summitpath Llp You Need To Know

We aspire to locate a proficient elderly accountant ready to add to our business's monetary success. For queries concerning this placement or the application procedure, call [Human resources contact information] This job posting will end on [date] Craft each learn this here now section of your job description to show your organization's special demands, whether working with an elderly accounting professional, company accounting professional, or an additional professional.

A strong accountant job profile surpasses detailing dutiesit plainly connects the qualifications and expectations that align with your organization's needs. Distinguish between necessary credentials and nice-to-have abilities to aid prospects gauge their suitability for the placement. Define any kind of certifications that are obligatory, such as a CPA (Cpa) license or CMA (Certified Management Accountant) designation.

Everything about Summitpath Llp

Follow these ideal methods to develop a work description that reverberates with the appropriate candidates and highlights the unique facets of the function. Accounting duties can vary extensively depending upon seniority and field of expertise. Stay clear of ambiguity by laying out certain tasks and locations of focus. For instance, "prepare regular monthly financial declarations and supervise tax obligation filings" is much clearer than "take care of monetary documents."Reference key locations, such as financial coverage, auditing, or payroll management, to draw in candidates whose abilities match your requirements.

Accountants assist organizations make vital monetary choices and improvements. Accounting professionals can be liable for tax obligation coverage and filing, reconciling balance sheets, helping with departmental and organizational spending plans, economic forecasting, communicating findings with stakeholders, and much more.